In the world of technology, virtual reality stands as a prominent and pervasive subject. However, the connection it shares with banking might surprise you.

What is the Metaverse?

The metaverse is a virtual reality platform that allows users to create and customize their unique avatars. This immersive realm not only enables interaction between digital objects, but also has the potential to enhance online shopping and bring events to life for a variety of customers, including those in the banking sector. Envision how your bank could exist within this expansive digital landscape. Would you opt for an avatar or a distinct digital representation of yourself? It looks very similar to “Ready Player One” movie by Steven Spielberg with his OASIS meta-universe; we are surely heading towards such an option when talking about banking!

The Evolution: How banks came to the Metaverse

At the moment, the banking industry has entered the fourth phase of evolution, with NFTs and cryptocurrencies taking center stage. At the same time, several banks have moved to the fifth – the metaverse stage. Let’s delve into the evolution of the metaverse bank and the challenges that have led us here:

Traditional Banking:

Once upon a time, banking operated on a two-tiered system, with central banks at the helm. It heavily relied on face-to-face interactions in physical branches and was predominantly paper-based, lacking personalization and financial product customizations.

Internet Banking:

The past decade ushered in the digital revolution in banking. This phase can be divided into two categories. Firstly, existing processes were digitized, enabling customers to access banking services through mobile and internet platforms. Secondly, new customer journeys were crafted to cater to the growing demand for digital-first services.

Open Banking:

Over the last three to five years, the banking industry has embraced openness by connecting with third-party services through APIs. This led to the emergence of neo-banks and cross-industry marketplace offers, including health services, automotive trade, energy services, and more.

Digitalized Finance Banking:

Web3 and blockchain technology brought about a secure, borderless, and fast banking economy. Notably, NFTs and cryptocurrencies played a significant role by introducing new financial assets, such as art, gaming assets, and real estate, to the market.

Metaverse in the Banking Sector:

In recent times, the metaverse has gained immense popularity across various industries, and banking is no exception. Virtual banking experiences are taking center stage, setting the scene for another revolutionary shift in the industry.

What Does the Metaverse Offer the Banking Sector?

The metaverse offers banks and financial institutions a unique opportunity to scale up. It is the metaverse that gives financial institutions a unique opportunity. What it brings to the table?

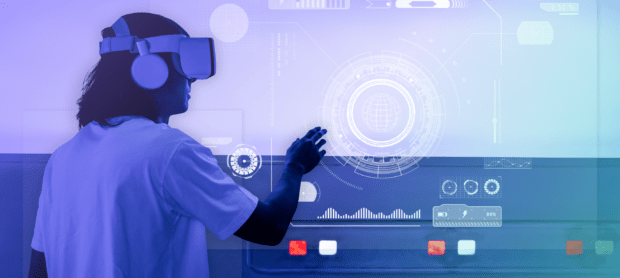

Rethinking Customer and Employee Experiences

The metaverse harnesses the power of AR and VR technologies, providing users with captivating and immersive experiences. For banks venturing into this realm, these technologies offer a chance to enhance their customer interactions. Through their virtual avatars, customers can seamlessly conduct banking transactions such as bill payments, fund withdrawals, and transfers. Moreover, they can engage with fellow customers and bank staff just as they would in the physical world.

Banks can use this for employee training as well. They can host training for professional development virtually, where employees can interact with each other in real time.

Elevating Customer Interaction

Online banking has undoubtedly brought convenience, but it often lacks the human touch. The metaverse addresses this limitation head-on.

By utilizing avatars, customers can engage in real-time conversations with bank employees. Whether it’s discussing their investment portfolios or planning their financial future, these interactions take place within the metaverse without requiring them to step out of their comfort zone. This eliminates the emotional disconnect that sometimes accompanies online banking.

Expanding the Scope of Operations

The metaverse signifies the emergence of an entirely new economy, one fueled by cryptocurrencies. Digital assets like NFTs (non-fungible tokens) and virtual real estate are witnessing a surge in demand. For financial institutions, establishing a presence in the metaverse opens up exciting possibilities in virtual currencies.

Why are some banks hesitant?

While some banks have made significant strides in this virtual world, many remain hesitant, and this hesitation can be attributed to two primary reasons:

Lack of Regulations

The metaverse operates without clear legal guidelines to govern its activities. For financial institutions, this raises concerns about the security and privacy of customer data. Without well-defined policies and robust redressal processes, ensuring the protection of financial information becomes a challenging endeavor.

Complexity

Metaverse is a complex concept. One that is highly dependent on other technologies such as AR and VR. For this, banks need to partner with experts to understand the capabilities of the space and how they can leverage it. However, such partnerships can entail substantial investments for banks.

The Future of Banking?

Is banking in the metaverse just another passing trend that will fade away as consumers lose interest? It’s a valid question, especially considering the rapid closure of physical bank branches. However, financial institutions are exploring the potential of the metaverse and virtual worlds to stay connected with their customers and offer essential banking services.

The growth of virtual economies and the trade in virtual goods and services is undeniable. As the younger generation matures and seeks to engage with financial services in familiar and comfortable environments, virtual spaces are likely to become their preferred platform.

The truth is, the metaverse remains an enigma, and its future appearance is uncertain. Yet, the banking and finance sectors perceive it as a significant aspect of our lives and are eager to embrace its potential.

Conclusion

The Metaverse financial market size is estimated to grow at a CAGR of 21.33% and increase by an impressive US $ 107.06 billion by 2027.

The banking sector might face significant obstacles in establishing a presence in the metaverse. However, the benefits of the space cannot be ignored. Institutions such as HSBC and JP Morgan have already begun leveraging new technology to deliver improved customer experience and diversify their operations. Banks looking to stay relevant in the digital era must do the same.

Dive into the future of banking with Eventyr! Are you ready to reimagine banking or any of the similar fields? Contact us today and find out how we can turn your ideas into reality.